401k Contribution Limits 2025 Roth 401k - How Much Can I Contribute To My 401k In 2025 Emelia, Getty images) by kelley r. The 2025 maximum contribution to a roth 401(k) is $23,000. This means that your total 401 (k) contribution limit for 2025 is.

How Much Can I Contribute To My 401k In 2025 Emelia, Getty images) by kelley r. The 2025 maximum contribution to a roth 401(k) is $23,000.

Retirement savers are eligible to put $500 more in a 401.

2025 Contribution Limits Announced by the IRS, Unlike roth iras, roth 401 (k)s don't have income limits. The roth 401(k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2023). This year the irs announced there will be an increase to the maximum employee 401 (k) contribution limit for 2025, increasing it to $23,000, a $500 increase.

401k Limits 2025 Roth Lacee Mirilla, Show pros, cons, and more. About 90% of 401 (k) plans now have a roth feature.

2025 401k Contribution Limits Roth Mady Sophey, You can contribute $23,000 in 2025 ($30,500 for those age 50 or older). For 2025, there’s a slight increase in the amount you can save in your 401 (k) plan.

The employee deferral limit increased by $1,000 and the. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

2023 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, Contribution limits for roth iras. See our picks for the best.

2025 Roth 401k Limits Moira Lilllie, 401(k) contribution limits 2025 retirement plans will rise from $7,500 to $10,000 annually beginning in 2025. The 2025 maximum contribution to a roth 401(k) is $23,000.

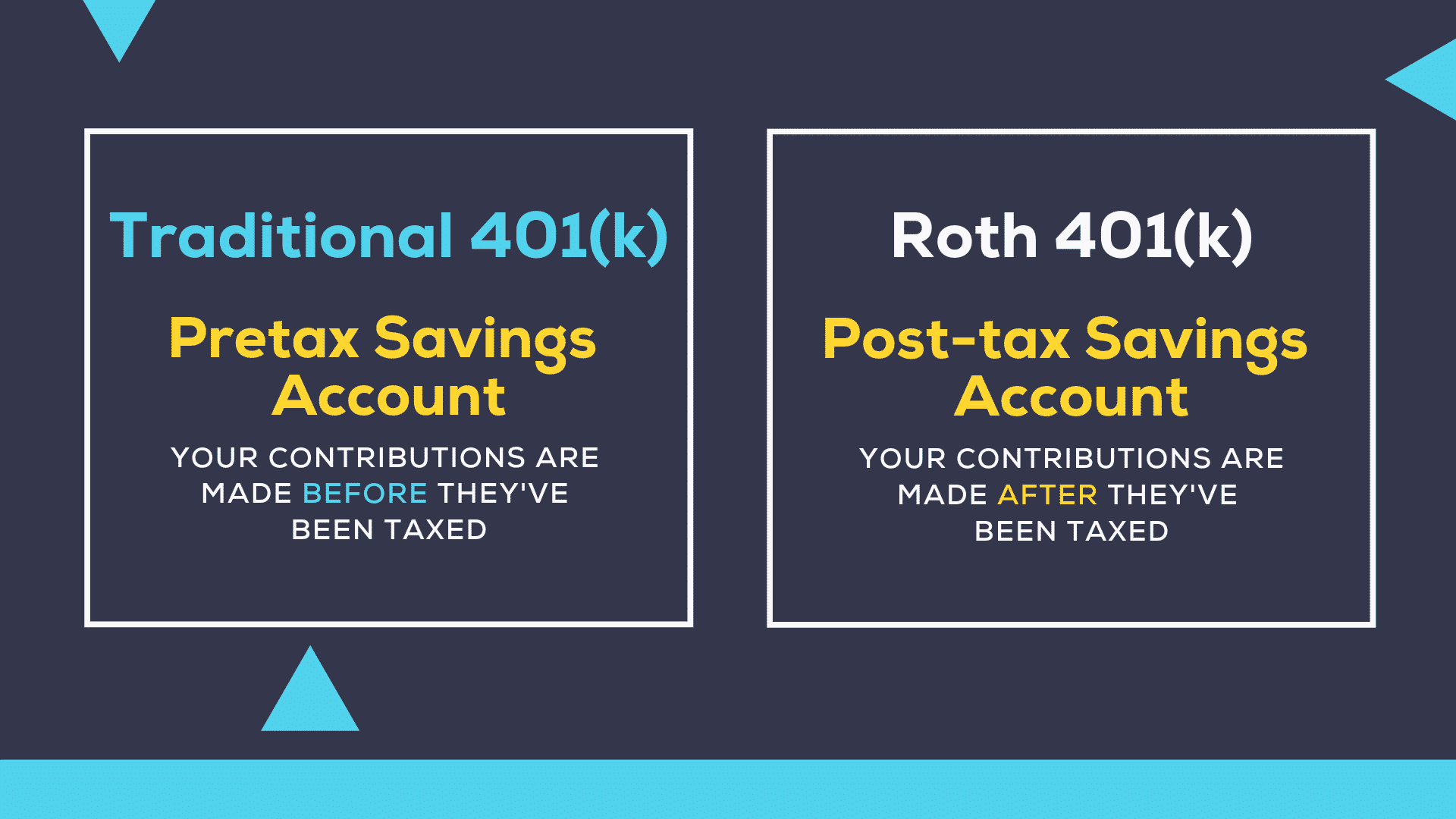

What’s the Maximum 401k Contribution Limit in 2025? (2023), Traditional 401k, the roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions. Retirement savers are eligible to put $500 more in a 401.

Retirement savers are eligible to put $500 more in a 401. The 2025 maximum contribution to a roth 401(k) is $23,000.

Simple Irs Contribution Limits 2025 Dore Nancey, Roth 401 (k) accounts don’t have an income limit for participation, but they do have annual contribution limits. Unlike roth iras, roth 401 (k)s don't have income limits.